Students may require additional money to fulfill their college requirements like fees, books, extra-curricular activities, food, tools, and much more. Moreover, situations of Instant & Urgent money requirements may rise where parents are unable to fund you. These are the times when Student Loan Apps come to your rescue. These are fast in processing, available anytime, and reliable. Also, the credit limit offered is good enough for students in India. However, there are also things you need to beware of as you know, “loan liya hai toh chukana toh padega (with interest…)”. We have got you the 5 Best Instant Loan Apps for Students in India in 2023 based on Interest Rate, Processing Fees, Trust Score, Eligibility, No-cost EMI, and many more factors.

I personally don’t recommend Student Loan Apps because the pressure of debt can cause misfortune & untoward events! However, on the other hand many students have used it responsibly and have had success.

Things to keep in mind Before using Student Loan Apps!

Interest Rate = Principal Amount x Tenure/365 x APR (annual percentage rate)

APR considers Interest, Processing fees, Late fees, and any other charges, and so is always higher than Interest. Thus, Low the APR, better the Interest Rate.

Interest Rate Decreases as Loan Amount Increases and vice-versa.

Higher Tenure = Higher Interest, and vice-versa.

Your CIBIL Score impacts Interest Rates. High CIBIL = Low Interest so always keep a knack of repaying on time or beforehand.

Your in-hand amount will be lesser than the loan amount because these apps deduct processing fees and other fees (if any) beforehand.

Most of these apps don’t reimburse you if you pay early, Infact some might reject you in future due to paying way too early.

They may call/sms/Whatsapp your contacts in case you fail to repay for adding peer pressure.

18% GST applicable on all other charges except Interest.

Loan Amount gets transferred to your Bank account so you need to have one.

You can convert Repayment Amount into EMIs.

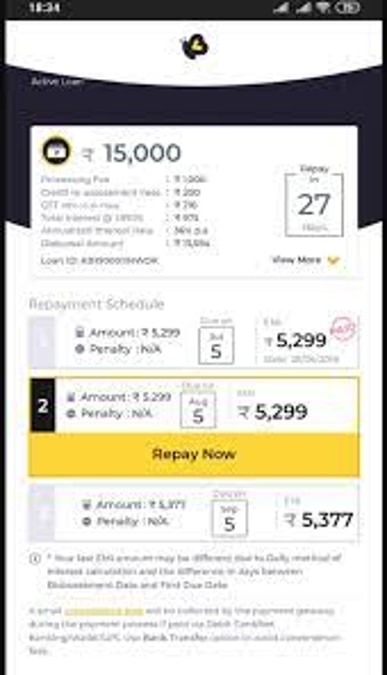

5. KreditBee

KreditBee is an Instant Personal Loan App. It promises loan disbursement into your bank account in around 15-20 mins post application. There are 3 loan types available out of which ‘Flexi Personal Loan’ is for students who are in the mid/last stages of graduation and those opting for higher education.

Loan Disbursal Time - 5 mins | make a note that processing & onboarding fee will be deducted from your disbursed amount.

Required Documents - PAN card and Aadhar card / Passport

Loan Amount Range - ₹1300 to ₹50,000

Tenure - 3 to 10 months

Eligibility Criteria - 21+ age | Indian | monthly income source | ₹25,000 min family income

Interest - 18% to 30% per annum

Processing Fee - 2.5% of loan amount, fixed in between ₹85 to ₹1,800 + GST | save on it via KreditBee Coupons and Refer & Earn

Onboarding Fee for KreditBee new user - ₹200 + GST

APR - 70% max

Partnered NBFCs include the likes of Piramal Finance, Chola, IIFL, Northern Arc, PayU, and Mirae Asset.

Cons

18+ students won’t be able to use it.

People have claimed rude customer care behavior. Also, they may call/sms your contacts.

KreditBee related Discussions:

4. mPokket

mPokket delivers quickly, and that too most of the time. It is a less tenure loan program keeping College Students in mind as it's better to free them early from the loan burden. One more interesting part here is mPokket Cashback (mCoins)! When you repay in time or early, this app rewards you with Cashback which can be redeemed against processing fees. Make a note that at start you will only be allowed to get a very limited amount loan i.e. ₹500 or ₹1000.

mPokket also has a ‘Shop’ section where you can buy Brand Vouchers, Restaurant Vouchers, Mobiles, Electronics, etc. It also rewards you with mPokket Cashback on shopping via it from affiliate partners such as Amazon and Flipkart. Moreover, you get ₹5000 in MyCash Rewards automatically as a mPokket new user on signing up. This amount can be redeemed in the Shop section.

Loan Disbursal Time - 2 to 5 mins

Loan Amount Source - Bank Account or Paytm Wallet

Required Documents - College ID, PAN card and Aadhar card / Driving license / Voter ID

Loan Amount Range - ₹500 to ₹30,000 | Usually you get upto ₹10,000 which can increase or decrease depending on your loan repayment activities.

Tenure - 2 to 4 months

Eligibility Criteria - 18+ age | College ID

Interest - 0% to 4% per month

Processing Fee - fixed in between ₹50 to ₹200 + GST

Late Charge - ₹8/day after due date

Refer & Earn - ₹75/referral

APR - 142% max

Cons

Interest rate is high, goes up till 48% p.a.

Shop section promises higher discounts, but fails to deliver.

It takes time to update loan repayment status in CIBIL which might impact your score.

Slow customer service

3. Pocketly

One of the best things about Pocketly is that you can close the loan anytime. Also, if you don’t have enough funds to repay then just pay the minimum due per month (EMI) and move on. For students, it gives ₹600 credit at start. You can take it up to ₹10,000 by repaying on time and following Pocketly norms. Pocketly follows a similar pattern to mPokket as it is also a low tenure loan program for students.

Loan Disbursal Time - Dynamic / User-specific

Required Documents - PAN card and Aadhar card | Video KYC

Loan Amount Range - ₹600 to ₹10,000

Tenure - 2 to 4 months

Eligibility Criteria - 18-30 age

Interest - 1% to 3% per month

Processing Fee - ₹20 to ₹120 + GST

Refer & Earn - upto ₹500 Cashback / referral

APR - 12% to 36%

Pros

Cons

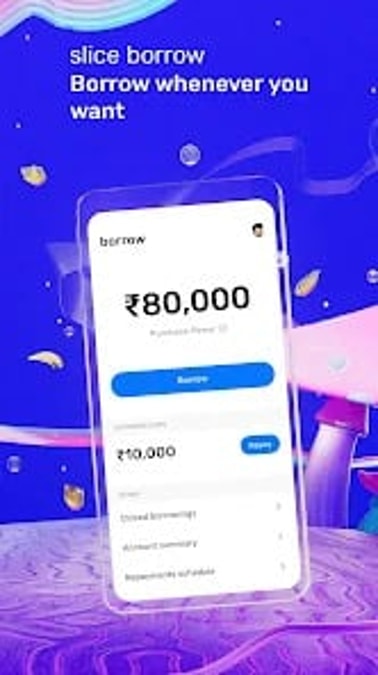

2. Slice Borrow

The Slice app has a section called Slice Borrow for student instant loans. The interest rate here is quite good comparatively. The reason why it is in the 1st place in this list is because it provides Interest-Free Loan for a month irrespective of the amount!

Loan Disbursal Time - Instant

Required Documents - PAN card | College ID

Loan Amount Range - upto ₹5 Lakh

Tenure - upto 12 months

Eligibility Criteria - Student

Interest - Dynamic / user-specific | 0% Interest if paid within a month

Processing Fee - 3% of loan amount | you might get a discount on it

A Sample Student Loan Application on Slice Borrow |

Credit Limit (purchase power) given |

₹23,324 |

Loan Amount opted |

₹10,000 |

Processing Fee |

₹290 (₹10 discount) |

Repayment Amount on/before 1 Month |

₹10,290 |

Max Tenure |

12 Months |

Interest |

14.26% |

APR |

29.39% |

Repayment Amount on completion of 12 Months |

₹11,716 |

12 Months No-cost EMI (if converted) |

₹977 (3 days cooling off period) |

Pros

Cons

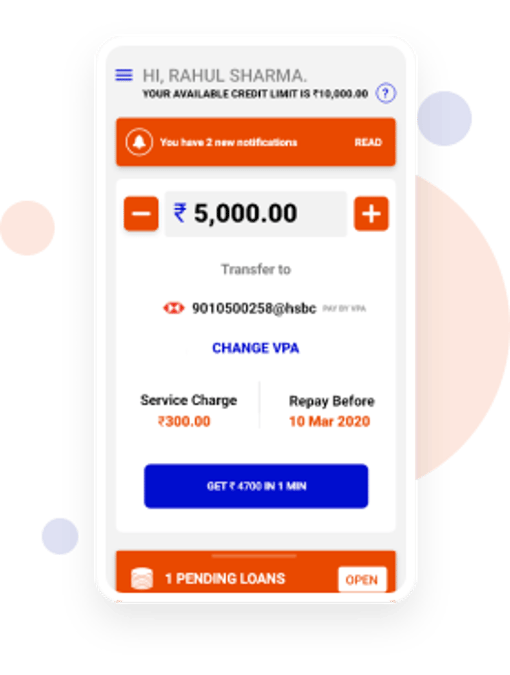

1. StuCred

StuCred is on the 1st position in our list of Best Student Loan Apps because of its highest trustability. Students from many popular Indian colleges have already used this app. Your credit limit will increase or decrease based on your loan repayment performance. Make sure you have a UPI ID as it uses only this method for bank transfer.

Loan Disbursal Time - 1 to 5 mins

Required Documents - PAN card | Aadhar card | College ID

Loan Amount Range - ₹1000 to ₹10,000

Tenure - 2 to 3 months

Eligibility Criteria - College Student

Interest - 0%

Processing Fee - 6% per month (all inclusive)

APR - 72%

Pros

Cons

StuCred vs Slice Borrow vs Pocketly vs mPokket vs KreditBee

|

APR |

Interest Rate (per month) |

Processing Fee (of loan amount) |

Rewards (for timely repayments) |

Trust Score (out of 10) |

StuCred |

72% (fixed)👎🏼 |

0% |

6% per month👎🏼 |

Lucky Cash (bank transfer)👍🏼 |

8👍🏼 |

Slice Borrow |

uncertain (maybe upto 40%) |

uncertain (0%👍🏼 if paid within 1 month) |

3% (discounts can be availed) |

Free Interest for a month |

7👍🏼

|

Pocketly |

upto 36%👍🏼 |

1-3% |

₹20-₹120 + GST |

Refer & Earn (upto ₹500 Cashback) |

5 |

mPokket |

upto 142%👎🏼 |

0-4%👎🏼 |

₹50-₹200 + GST👎🏼 |

mPokket Cashback |

5 |

KreditBee |

upto 70% |

1.5-2.5%👍🏼 |

2.5%👍🏼 |

KreditBee Coupons |

6 |

You will come across many articles on the web which showcase the Best Student Loan Apps but beware because many of them are for salaried/self-employed only. These are included in the list because they are useful for education loans. However, when we talk about Student Loans, it has slight/no resemblance with Education or Higher Study Loans. Moreover, India has banned 232 Betting & Loan Apps linked to China recently!

Follow Us

Follow Us

Better take education loan from Nationalized banks

No to these third party apps please.

Usually government sette the intrest part.