- 908 Views

- 4 Comments

- Last comment

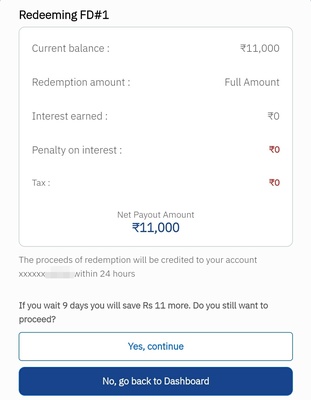

no charges as per the FAQs section on the app.

Too less interest.

Who gives more than 7.25?

Thanks but didn’t get it to work. After providing all docs for kyc it never finishes process

ohh  you can check with Google Pay support for this issue.

you can check with Google Pay support for this issue.

None of ICICI, HDFC, AXIS and SBI offer > 5.5 % for 365 days.

So 6.35 for 1 year is good.

FD upto 5 LACs from one bank is secured by government.

I would probably give this try.

I think all banks give securities in FD for 1lakh only if anything happens.

Better to keep the money in mutual funds and diversify the portfolio.

Equitas FD is available on Groww also. Which platform is better?

Cred mint seems better at 9% .. but it’s P2P not everyone going to trust it. Also min investment is 1lakh

Dont even think of P2P, not even Cred Mint. Even your capital will be at risk.

FD is too low. Mutual funds anyday better. And it gives you flexibility to withdraw or add more.

Also for who are thinking to invest on this apps, I would suggest you to directly invest with banks than these apps.

These guys are just facilitators and will not provide any sort of help if there are any issues.

Buy HDFC Bank share @ 1580 today and hold for a year or 2, you will get 10-25%

Buy USDT on Zebpay and lend for 3 months you will get 12%. Banks give chiller, don’t waste you time and money in FDs

But how safe it is? Also, is it a stable coin like bitcoin.

Not secured 2days days back my gpay acc temparary suspended i dont know

Same is already available at Groww app since long time. I invested in Equitas FD 10-12 months ago. Good find though.

Bajaj Finserv FD is also a good option with 6.75% interest.

Yes, That is much better considering Bajaj Finserv is very much profitable company but only drawback with that is, You can’t take premature exit from FD otherwse there is certain penalty on other side there is no penalty on Equitas.

in my area krishna bhimma samrudhi local area bank is there which gives 7% is it safe for fd?

Absolutely not.

Invest in any large cap fund and get better than this.

the cooperative bank near my home gives 12%!! but gpay definitely would have better practices in place. having said that idfc niyo was offering 7%. now idk how much that is. no way to find the roi

The subject of this thread is misleading.. i dont think its google pay fd.. google will not be liable to pay you in case the company booking the fd goes down..

They reduced the interest rates now

How much fd is safe in Bank 1 or 5 lac

Overall sum(saving/FD/RD, etc) in bank is secured upto 5lac under DICGC

Are they going to deduct tds?

Now it’s 5.85% for one year

Post office offline FD offers 6.87% for 5 years deposit.

Can we trust Bharatpe 12%

Good information

what about safety?

IndMoney in partnership with SBM Bank 7.65 percent interest .

There was a option of getting monthly interest payout where according to the calculation an FD of 5 lakhs would give me 3k per month interest.

What about Bharat pay 12%club..

Can’t take Risk with Google

Follow Us

Follow Us

Just created a FD of 10 days for trial. There is no redemption charge. You will get the principal amount plus the accrued interest in the source account within 24 hours post redemption request.