Google Pay in partnership with Equitas Small Finance Bank has started the Fixed Deposit service on its mobile app. This service is powered by the Setu API. Google Pay users can now book FDs on-the-go instantly on the app. Currently, this bank promises upto 6.35% interest rates (extra 0.50% for senior citizens). Moreover, any bank customer can open Google Pay FD.

Currently, the Google Pay Fixed Deposit service by Equitas Small Finance Bank is in its beta stage so may roll out more features soon. Moreover, Ujjivan Small Finance Bank and AU Small Finance bank are expected to join Equitas in this FD program.

Equitas Small Finance Bank is RBI regulated. Moreover, it promises upto 7.25% interest rates (above 1 lakh) for senior citizens. Besides, you can close your FD anytime instantly. Therefore, it makes a good option for Google Pay FD.

How To Open Google Pay FD of Equitas Small Finance Bank?

You can open your Equitas Small Finance Bank Fixed Deposits on Google Pay instantly. Follow the below mentioned steps to get started.

- Open Google Pay app.

- Scroll down a bit to “Businesses & Bills”, and click on “Explore” (to the right).

- Search for “Equitas” and select “Equitas Small Finance Bank”.

- Now, click on “Open Equitas FD”.

- Click on “Invest Now”.

- Verify your Google account (auto-verification)

- Verify mobile number (should be same as in Aadhar Card)

- Verify PAN Card.

- Verify Aadhar Card.

- That’s it! Start making your desired FDs.

Related Read : Paytm partners with HDFC Bank to provide financial solutions to consumers and merchants in India

Google Pay FD Interest Rates of Equitas Small Finance Bank

You can open a Equitas Small Finance Bank Google Pay FD for upto 1 year tenure. The Google Pay FD Interest Rates for this bank varies from 3.5-6.35%. Besides, senior citizens can avail an extra interest of 0.50% on their FDs here.

Tenure (in days) |

Interest Rates (extra 0.50% for senior citizens) |

7-29 |

3.5% |

30-45 |

3.5% |

46-90 |

4% |

91-180 |

4.75% |

181-364 |

5.25% |

365 |

6.35% |

Google Pay Fixed Deposits FAQs

Here are some of the common Google Pay Fixed Deposits FAQs.

Who all can open FDs on Google Pay?

All Google Pay users can open FDs on Google Pay app, but current Equitas Small Finance Bank users cannot open FDs on Google Pay (as of 30th Aug 2021).

How much amount can I deposit in Google Pay Fixed Deposit Account?

Currently, Equitas Small Finance Bank allows a min of Rs 5000 and max Rs 90,000 to deposit in a single FD.

Where will my FD maturity amount get deposited?

Your FD’s maturity (principal & interest) amount will be deposited in your bank account (primary) which is linked to Google Pay.

How many GPay Fixed Deposit can I make?

Currently (30th Aug 2021), you can make only 1 Google Pay Equitas Small Finance Bank FD as it is in beta version.

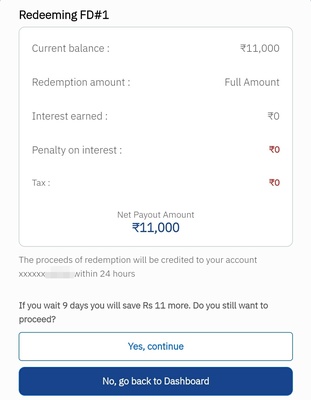

How to close GPay Fixed Deposit?

You can close your Google Pay FD anytime by clicking on “Redeem your FD” from the “My FDs” section on the Google Pay app.

How to Renew GPay FD?

Most probably your Google Pay FD will get auto-renewed, but still check with the bank or Google Pay.

What are the charges to open a GPay FD?

There are no charges (free) to open a Google Pay FD.

What are the eligibility requirements to open a Google Pay Fixed Deposit?

You need to be a Google Pay user and complete user & KYC verification to be eligible for Google Pay Fixed Deposit account.

With the FD interest rates at all-time-low in India, will people go for this GPay FD? Do let us know your opinion on this in the comments section.

A special thanks to our Dimer LUKA186 for 1st breaking this Google Pay Fixed Deposit Launched news.

Just created a FD of 10 days for trial. There is no redemption charge. You will get the principal amount plus the accrued interest in the source account within 24 hours post redemption request.