Mclr and repo rate both are different ? If yes then what is advisable ? Switch to mclr or repo rate ? TIA

Hi, Am assuming you are referring to RLLR (Repo based home loan rate). So MCLR is usually lower than RLLR but RLLR is more transparent as it gets revised every month and beneficial right now due to reducing interest rates… It also means it will increase faster when rates will climb up.

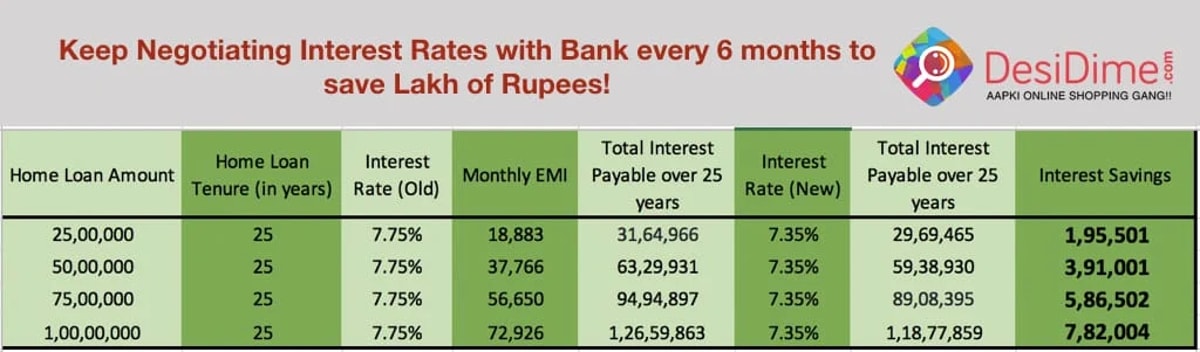

I have a Home Loan with Citibank and I have something called as CMPR which is “Citibank Mortgage Prime Rate”. My current interest rate is 5.3%. My point is that first try to negotiate very hard in whichever interest regime your home loan is. Obviously you can compare the different interest rates for different regimes but end of the day, what really matters is how much you negotiate, otherwise u will always be put in higher interest rate of the slab bank offers to customers.

Stop non essential expenses like mobile, tv, car, gadgets, expensive vacations and prepay principal amount

Live minimalist life for 4-5 years

what about consumer durable emi? Any news on moratorium?

My interest rate is 7.2% in icici

Mine is at 7.4% with ICICI

Great and excellent post

I have a home loan with axis bank and received this sms in April. After that no revision done.

“Dear customer, MCLR reset effect has been passed on to your loan a/c no. XXX. Your revised ROI is 8.00 % wef 18-04-2020. Thank you.”

Please suggest if anything better can be done.

As suggested in article, Check other Loan options. Call the bank and negotiate… Tell them that you will switch, if you are not offered better interest rates… Convince them that you pay on time, you are good customer and you dont want to switch for few basis points but bank has to make it little better. Repeat every quarter.

Even if you get 0.1% to 0.2% down, You can be rest assured that you have got the sweetest deal (maybe 10-15 loots of Desidime  )

)

are you Citi Gold / private client ?

Very informative. Thanks

I have couple of doubts, please clarify

1.Is it applicable for education loans? Bz i have a education loan and its interest rate is 10.5% in canara bank taken in 2015

For home loan…

2. Should we call bank customer care or the branch?

3. We have a home loan in canara bank was taken in 2009 and its present interest rate is 8.25%…can it be reduced still?

4. Is overdraft and OD account both are same?

1. Not sure about educational loans but no harm asking. It’s same like Mobile Data plans. If you ask/negotiate than better plans are always available to retain customers. They would not want to loose a customer for 0.2% to 0.5% but for us, it will add up to significant savings.

2. Customer care. Branch would always generally care only to get new customers.

3. Yes, for sure. Even my loan was taken in 2009 only and I use to call them often till last year.

4. yes mostly same (unless u are asking about some specific product – like savings account OD is different than Home Loan OD obviously.)

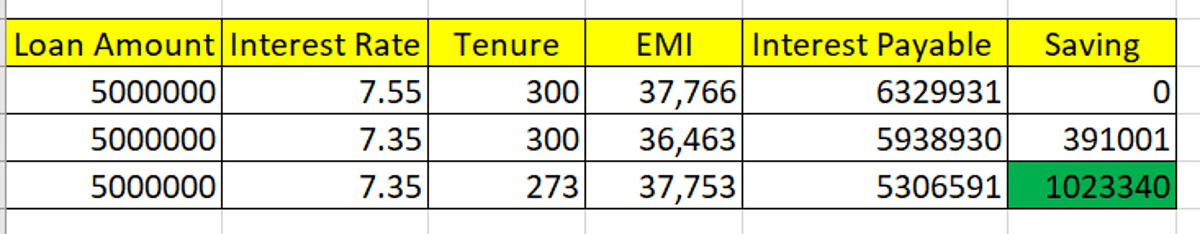

h2. Its 10.2 Lacs compare to 3.9 Lacs

In My example I reduce the tenure from 300 months to 273 months (-27 Months) and see the magic. My EMI amount it same as its is.

Think wise !!!

h2. Its 10.2 Lacs compare to 3.9 Lacs

In My example I reduce the tenure from 300 months to 273 months (-27 Months) and see the magic. My EMI amount it same as its is.

Think wise !!!

yes, Very good point and thanks for your contribution. It always helps when Dimers share their experiences… It helps all of us to save.

The only thing i would like to add, is first one must pay Higher interest loans so increasing EMI amount/lowering tenure must only be done if you have paid off higher interest loans first. So if you can pay 20k worth of loans in a month, first preference should always be as much EMI as possible on higher interest loans. But yes, if someone is keeping money in FD then lowering tenure is a magic pill

PS: Hope you wont mind if i add your screenshot to my original post. Will give you credits obviously.

PNB is looting me on 9.55% despite being salaried and it’s my pre EMIS.

Have been paying since 3 years. Possession is due now.

And loan amount is INR 35,00,000

Need help. Can anyone suggest?

Already in process of BT with HDFCHFL for 7.20%

Any better offer?

How to complain about PNB bank? The bank had confirmed the waiver of 0.30% in June and till date they haven’t revised my interest rate despite they mailing me about the confirmation. The customer care always goes unanswered, emails go answered and resolution is 0. Tickets created on app gets automatically closed. What to do? Please suggest! Need help!

I have a SBI home loan..is there any bank providing lesser interest charge on home loans?

Go with SBI..even though I have aversion to public sector companies..wen it comes to reduction of interest rates SBI is the first one most of the times to reduce the rates.i transferred from ICICI to SBI and last tym I checked interest rate was 6.95 repo rate.Though initially you will have to visit the branch multiple times and also go to their center couple of times I think quite worth it.Also now a days they are quite active in helping you out for loan.In my case I mostly got all the forms filled through home visit.

Any idea if someone has a Property insurance and also a Term insurance of loan payer attached with Home Loan (which these days are pushed compulsorily to loan seekers) and if we opt for switching Home Loan to some other Bank then will these insurances get lapsed or remain valid?

I have had home loans from hdfc, axis, kotak bank but none comes close to the interest rates and services offered by citi bank. Would strongly recommend to try and get your home loan or mortgage loans from citi bank. They are very selective in doing business but there’s no harm in trying. Another benifit is that they will never charge you for anything except your emi amount. No hidden charges or costs like annual maintenance charges.

Great to see that other Citibank customer also has Interest rate near 5.5%

I totally agree that Citibank has been a very good bank to deal with.

Hi all, too bad I found this post so late.

Please, I will be grateful if you experts can help me in some way.

I got loan with HDFC of 45 lacs for a very very small property as costly as it gets in Mumbai. Last 2.5 years I am paying emi at 8.90 floating which has been set to 8. 25 now by HDFC. Property is still under construction and due in next 7-8 months. I am trying to apply for PMAY but I don’t know the actual property photos required. I went TO HDFC office last week asking for both, but they didn’t clear what kind of photos of property are required. There is no construction board at the site.

Secondly I got message from other banks like Kotak and citi asking for loan transfer at a better rate like 6.9 and 7.1 which is lot better than my current 8.25. But HDFC executive that they can give me 7.35 under interest conversion at the most that too at a cost. Then again i learnt I will lose pmay eligibility if I change. Please help some one and guide me what to do.

Its correct that if you are getting PMAY subsidy and if you transfer loan to another bank, you will lose the eligibility. Transfer of loan is considered as pre-payment by other bank on behalf of you and any pre-payment voids the subsidy, as far as i understand.

But yes, congrats that you atleast got it changed from 8.9 to 8.25. It’s a significant savings.

Sometimes repaying faster is not advisable….as you won’t get cash in such low rates for other purposes…so either invest or purchase the priority items (car etc., as interest is high for car loans) with the excess cash. Repay excess when your investment is not giving returns more than home loan interest…

Exactly. I have sbi max gain account. So even if I make outstanding amount to 0 by parking extra saving to maxgain, still I will not close loan account until its tenure, as in emergency situation we might not able to get immediate money at this low interest rate. Beside, we get tax exemption too

My Uncle is going to take home loan in month of Feb 2021 & currently inquiring from different banks.

Amount of loan Required – Rs. 30 lakh; Proposal received by him are as follows:-

1) HDFC – Interest rate – 7.10%, Tenure – Min 20 years

2) PNB – Interest rate – 7.15%, Tenure – Min 15 years

3) Union bank of India – Interest rate – 7.05%, Tenure – not available

My Query is regarding 3 things, If anyone can advice it will be of great help

a) What is the minimum TENURE [loan period] offered by banks for home loan.

b) If we pay more than calculated EMI than the amount will be first adjusted with Interest component or Principal amount.

c) Are proposals received by him are in line with current market rates.

Thanks

P.S. – He has no idea/ experience whatsoever regarding any loan from any banks. Neither Do I.

Check with BOB or SBI you may get better interest rates.

A. Not sure of the min Tenure, but most people take 15 or 20-year term: HDFC has both 15 and 20 years term..

But I know a few friends who took loans for a tenure of 10 years also..

My suggestion is to take a longer period, as you can always close the loan earlier if you have money, but if you take a shorter tenure EMI will be high in case unfortunate conditions it will be difficult to pay. so Choose a longer period and do prepayment every now and then if you want.

B. Atleast for HDFC you can not pay random amounts, for prepayment you need to pay min of 3 EMIS and yes prepayment goes directly towards the Principal part only.

C, yes they are pretty much inline.

Thank you for sharing the topic.

Got me off my couch to the bank.

They charged me 1180 Rs. And converted my loan from 8.1% to 6.95% (Icici bank)

🙏

Very happy to hear that it helped someone

I managed to avoid taking whatever insurance they were trying to push. Now if I switch to a different bank, will they try to push the insurance thing?

Follow Us

Follow Us

I have a home loan with axis bank and received this sms in April. After that no revision done.

“Dear customer, MCLR reset effect has been passed on to your loan a/c no. XXX. Your revised ROI is 8.00 % wef 18-04-2020. Thank you.”

Please suggest if anything better can be done.

As suggested in article, Check other Loan options. Call the bank and negotiate… Tell them that you will switch, if you are not offered better interest rates… Convince them that you pay on time, you are good customer and you dont want to switch for few basis points but bank has to make it little better. Repeat every quarter.

Even if you get 0.1% to 0.2% down, You can be rest assured that you have got the sweetest deal (maybe 10-15 loots of Desidime )

)