2 days have gone (1 to go) into the Global FinTech Fest 2023 going on in Mumbai where RBI Governor Shaktikanta Das announced some new payment systems launched by the NPCI. Below is the list.

UPI ATM

Credit Line on UPI

UPI LITE X

Tap & Pay

Hello! UPI

BillPay Connect

UPI ATM

UPI ATM is India’s 1st card-less cash withdrawal ATM machine. Using UPI ATM you will be able to encash money with your mobile via UPI apps. Hitachi Payments is the co-developer of this revolution with NPCI. Get detailed info in this UPI ATM launched! How to Withdraw Cash, Available Locations & more article.

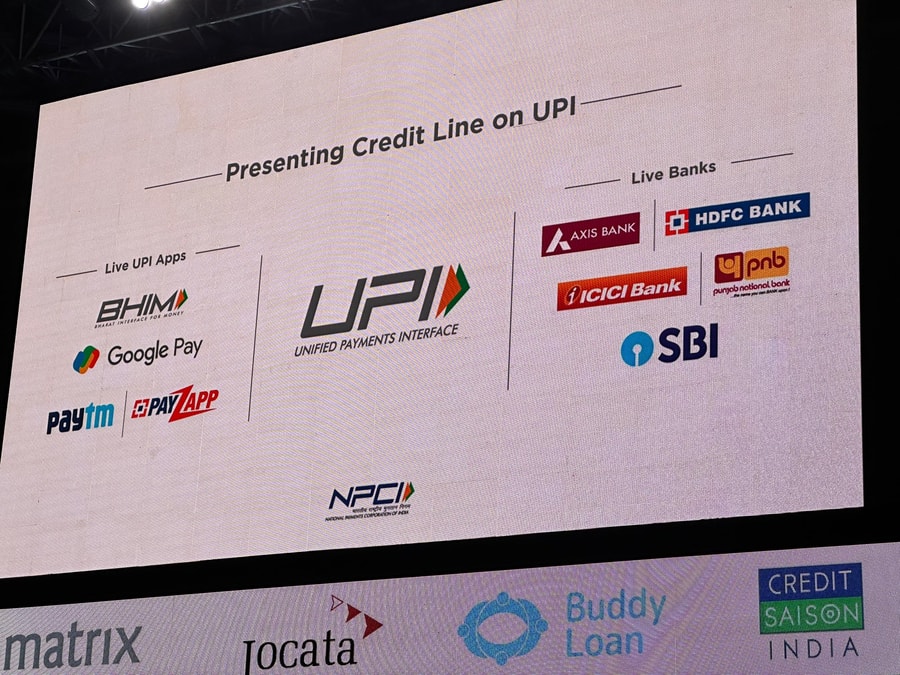

Credit Line on UPI

Credit Line on UPI will give you a pre-sanctioned credit amount (subject to a limit) from banks via UPI. This amount will be different for all depending on bank balance, assets value, salary, CIBIL score, and other financial points. It will be available on all major banking and UPI apps such as Google Pay, Paytm, PayZapp, and BHIM. You can resemble it with ‘buy now pay later’ (interest-free for a few days) apps.

UPI LITE X

UPI LITE X is the modified version of UPI LITE. The former was made for quick small payments of under ₹200 while the latter will support upto ₹5000. You can use UPI LITE X to send and receive UPI payments offline. Thus, people in remote areas and poor internet connectivity zones will benefit.

UPI Tap & Pay

credits: abhishek012

UPI Tap & Pay will work via a NFC enabled QR code and device. You simply need to tap your mobile on the QR code (instead of scanning), enter the amount (merchant can also enter beforehand) and UPI pin to complete the transaction. You can also get a UPI tap & pay card as shown in the image above, from participating banks. This card can also be attached to your mobile. JioPhone has also got the UPI tap & pay feature. Thanks @abhishek012 for this important info!

Hello! UPI

Hello! UPI uses your voice commands to complete a UPI transaction (needs UPI pin validation at the end). You can use Hello! UPI via UPI apps and IoT devices. For instance, you can say “pay my Tata Power electricity bill of ₹2000”. It will be available in Hindi and English, and more languages will be added later-on.

BillPay Connect

BillPay Connect is by Bharat BillPay. It will have an app where you simply need to send ‘Hi’ and press some following buttons to pay your bills. It will also have a nationalized phone number (automated tele-calling machine) where you can place a call, give voice commands or press desired numbers for bill payments. Missed-call bill payment facility is also expected to be available here.

NPCI will also set up payment soundbox devices at physical bill collection centers. After payment, these devices will instantly voice acknowledge your bill payment. You can find the Global FinTech Fest 2023 Day 1 and Global FinTech Fest 2023 Day 2 highlights.

Follow Us

Follow Us

NPCI is really "innovating" payments. UPI and then UPI Lite and now UPI Lite X. That's in addition to IMPS and BBPS which came before. They are listening to feedback and coming up with improvements. My single biggest grudge with UPI was the Rs 5 / 10 transactions in my savings account statement for all the public transport commuting. UPI Lite has been a godsend for me.

One just needs to spend some time in a country outside India to realize how far ahead we are when it comes to payments. Don't even mention VISA/Mastercard or Alipay/WeChat Pay because they are all privately owned for-profit entities. The former also takes a cut out of the merchant's profits and are useless for P2P (peer to peer) payments (e.g. between friends and family).

NPCI is really "innovating" payments. UPI and then UPI Lite and now UPI Lite X. That's in addition to IMPS and BBPS which came before. They are listening to feedback and coming up with improvements. My single biggest grudge with UPI was the Rs 5 / 10 transactions in my savings account statement for all the public transport commuting. UPI Lite has been a godsend for me.

One just needs to spend some time in a country outside India to realize how far ahead we are when it comes to payments. Don't even mention VISA/Mastercard or Alipay/WeChat Pay because they are all privately owned for-profit entities. The former also takes a cut out of the merchant's profits and are useless for P2P (peer to peer) payments (e.g. between friends and family).

So TRUE bro....

ONLY when one goes abroad realizes this how advanced India has become and how backward and lagging the West is....

Digital India has Really taken off....

And Made in India also to a large extent...

What a time to be alive...