SBI or State of Bank of India has launched 2 new SBI Reliance Credit Cards (RuPay) and it offers some interesting benefits and rewards. One of our active finance-enthusiast users, @abhishek012 first informed us about the same in our discussion thread recently: Two New SBI Reliance RuPay Credit Card launched. While users aren’t as excited about these cards, you need to know the complete details and decide for yourself whether or not you want to apply for these SBI Reliance credit cards. So let’s get to it: New SBI Reliance RuPay Credit Card details, Rewards, Fees & more

SBI Reliance Credit Cards Details

SBI recently reported its highest-ever quarterly net profit of Rs 16,884 crores for April-June 2023 and the bank recently lended money to Ola Electric EV business ahead of their IPO. Overall, it's been a profitable year for the state bank. In a recent news report by our user, two new SBI Reliance Rupay Credit Cards were spotted, one of them is SBI Reliance RuPay Credit Card & SBI Reliance Prime Rupay Credit Card.

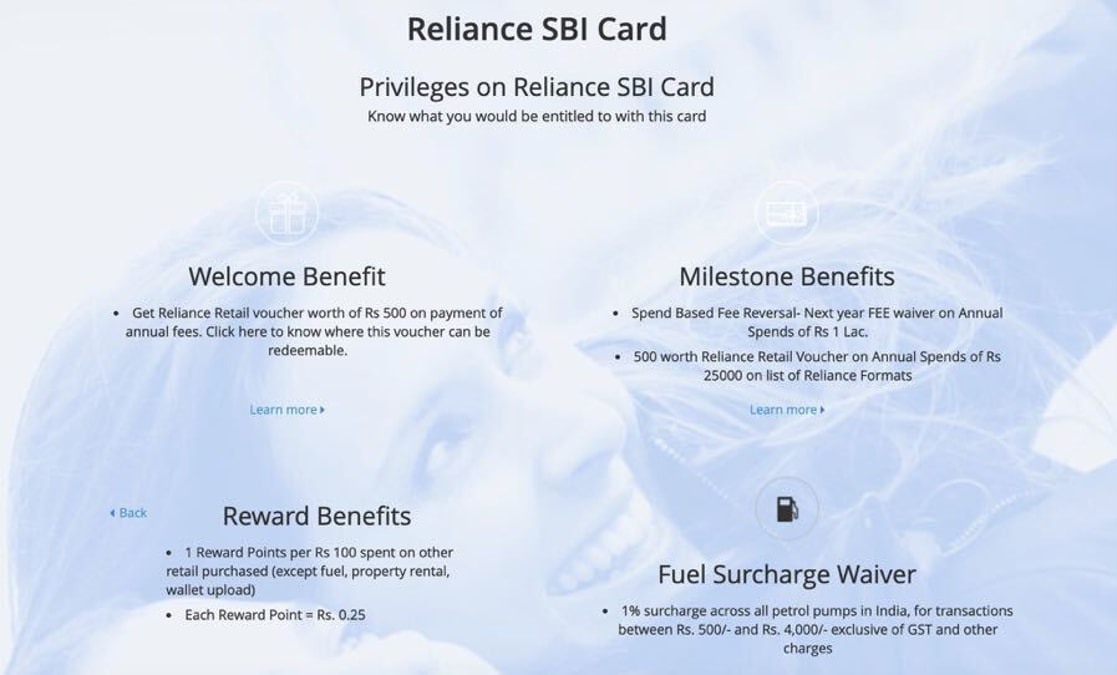

These Reliance SBI co-branded credit cards bring various voucher benefits. However, the catch is that these vouchers are only applicable to Reliance-owned brands or companies where Reliance has a stake. Let’s have a look at the SBI Reliance Credit Card welcome benefits to understand this better:

SBI Reliance Credit Card Welcome Benefits |

Rewards |

SBI Reliance Rupay Credit Card |

SBI Reliance Prime Rupay Credit Card |

Reliance Trends |

Rs.500 voucher on minimum purchase Rs.2499 |

Rs.100 voucher on minimum purchase Rs.3999 |

Ajio |

Rs.250 voucher on minimum purchase Rs.1499 |

Rs.750 voucher on minimum purchase Rs.3999 |

Centro |

Rs.500 voucher on minimum purchase Rs.3000 |

Rs.1000 voucher on minimum purchase Rs.6000 |

Zivame / Clovia |

Rs.300 voucher on minimum purchase Rs.1199 |

Rs.500 voucher on minimum purchase Rs.1999 |

Converstory |

Rs.250 voucher on minimum purchase Rs.1499 |

Rs.2500 (max 10% of bill value) |

JioMart |

Rs.100 voucher on minimum purchase Rs.500 |

Rs.250 voucher on minimum purchase Rs.1250 |

Urban Ladder |

Rs.500 voucher on minimum purchase Rs.4999 |

Rs.2500 (max 10% of bill value) |

FashionFactory |

Rs.500 voucher on minimum purchase Rs.1499 |

Any denim Rs.999 (using promo code) |

Netmeds Online |

Rs.200 voucher on minimum purchase Rs.1499 |

Rs.500 voucher on minimum purchase Rs.1999 |

Reliance Jewels |

NA |

Rs.2000 voucher on minimum purchase value of Rs.49,999 Diamond Jewellery |

On top of these welcome benefits, the SBI Reliance co-branded credit card also offers a 3,000 worth Reliance Retail voucher on payment of joining charges for Prime variant card holders. The same is 500 INR worth of Reliance Retail vouchers for non-prime card holders.

Looking at the rewards, the SBI Reliance Credit Card benefits aren’t the most appealing. The value of one rewards point is 0.25 INR for both Prime and non-prime variants of the SBI Reliance Credit Card. However, with the prime one, customers can earn 10 reward points per 100 spent as opposed to 5 Reward Points per 100 in the normal variant. If we compare it to other credit cards like Axis Ace, Flipkart Axis, and Amazon Pay ICIC, you can better rewards with them.

Here’s an example for you to understand this better:

Check out our credit card offers group to not miss any latest offers and deals.

As you can see, using an SBI Reliance Credit Card, you can make a savings of Rs.125 on a transaction of 10,000, and using other cards you can earn even better rewards of up to 200.

However, for the SBI Reliance Prime credit card, you earn better rewards as compared to the other ones listed in the table.

But hold on a minute, we need to address the big elephant in the room first of all and there are two of them: 1) the fees of these co-branded SBI Reliance cards.

The SBI Reliance Credit Card fee is Rs.499 + GST and the annual charges are the same while the SBI Reliance Prime Credit Card has a fee of Rs.2999 + GST.

2) The above-mentioned reward points are applicable only on payments except for UPI. For UPI-based payments, these reward points are even lesser.

Given customers can now easily link their RuPay credit card to UPI to enable UPI payments, this limitation on the reward points on UPI payments, seems less favorable.

By the way, on a side note, Axis recently launched the Axis Bank Numberless Credit Card & AU Small Finance Bank has launched a green FD that just might be offering the highest FD interest rate (up to 8.50%) currently.

Speaking of the eligibility criteria for these SBI Reliance credit cards, there are not many details out yet. However, you can visit this original thread to learn more about the other benefits, features, and milestone benefits of these SBI Reliance cards.

Do share with us your thoughts on this new SBI Reliance credit card. What do you think of them? Are these credit cards worth applying to? If not what would be a better alternative to these?

Latest News:

Follow Us

Follow Us

news articles are not only for forum users Loaferg..if there's something good in the forum, we try to cover it on news so that it reaches users beyond DD..also have already provided him credits in the article