NFO alert! SBI has launched its SBI New Fund Offer (NFO), SBI Energy Opportunities Mutual Fund which is currently open for subscription until 20th February. The allotment date is 26th February. With only some days for the new fund offer to close, here’s all you need to know about the newly launched & SBI Energy Opportunities Fund, allotment date, minimum investment amount, fund managers, fund plan and plan type.

SBI Energy Opportunities Fund: What is it about?

SBI Energy Opportunities Fund is a new open-ended equity scheme that follows the energy theme. As the name suggests, the fund focuses especially on companies engaging in the production, transportation, and processing of oil, gas and power sectors.

What is an Open-ended Equity Scheme? 💡

An open-ended equity scheme or mutual fund is basically a fund that you can buy/sell anytime (taxes/exit load will apply depending on your tenure)

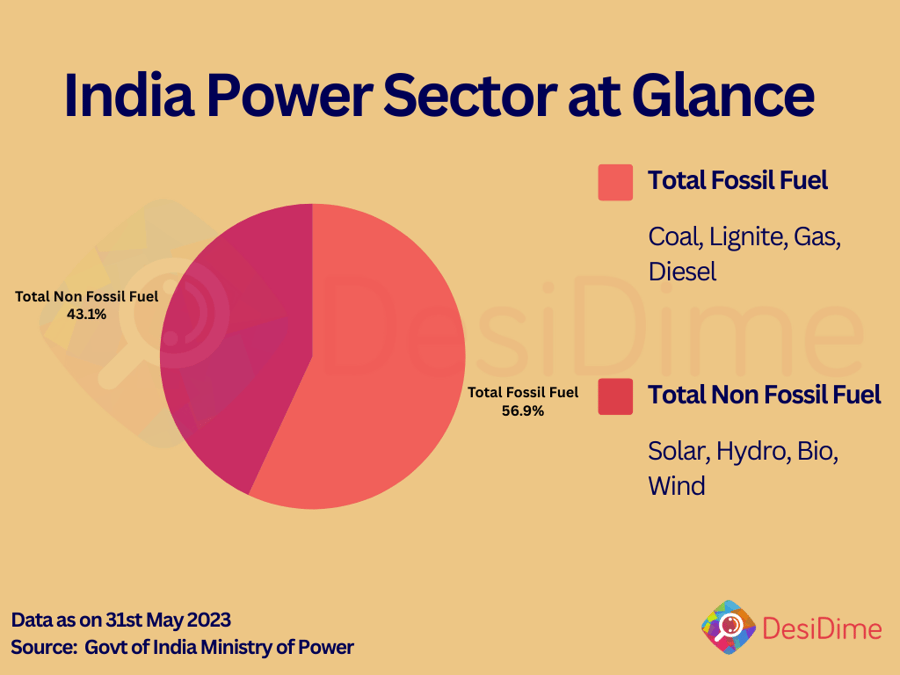

SBI claims to be adopting the Barbel portfolio approach for its SBI Energy Opportunities Fund. Explaining the approach, SBI says it’s an optimal mix of traditional and new energy.

Traditional Energy |

New Energy |

Oil |

Solar |

Natural Gas |

Wind |

Coal |

Hydrogen |

Petroleum |

Bio |

Nuclear |

Tidal Energy |

Fossil fuel |

Hydropower |

Traditional energy is more fossil-fueled (more carbon print) which is something that the world is slowly taking steps to find alternatives to or shift away from. Of course, given the value chain oil, gas and these fuels have, we cannot simply, completely negate them right away.

SBI Energy Opportunities Fund Details (Type of Scheme, Minimum Investment & more)

Scheme Name |

SBI Energy Opportunities Fund |

Type of Scheme |

An open-ended equity scheme following the energy theme |

Investment Objective |

Long-term capital appreciation by investing in traditional & new energy sector |

Plans & Option |

Regular & Direct |

Application Amount |

Minimum Investment Amount: Rs. 5000/- and in multiples of Re. 1 thereafter;

Additional Purchase Amount: Rs. 1000/- and in multiples of Re. 1 thereafter

|

Fund Manager |

Mr. Raj Gandhi (15 Years experience)

Mr. Pradeep Kesavan (overseas securities) (18 years experience)

|

Benchmark |

Nifty Energy TR Index |

Exit Load |

Exit on or before 1 year from the date of allotment: 1%

For exit after 1 year from the date of allotment: Nil

|

NFO Open Date |

6th February 2024 |

NFO Close Date |

20th February 2024 |

Allotment Date |

26th February 2024 |

So, this was all about sharing the SBI Energy Opportunities Fund launch date, allotment date, NFO closing date and application amount that interested investors would need.

“Now, India stands 5th in solar PV deployment across the globe at the end of 2022. Solar power installed capacity has reached around 70.10 GW as of 30-06-2023,” said a report from the Ministry of New & Renewable Energy, India.

As per a report from IEA, China has invested USD 50 billion in solar which is 10 times more than Europe.

As of 2023, China is said to have a record 525GW PV Capacity which is almost 7 times more than the PV capacity we have currently in India.

On a side note, consider checking out our latest credit card offers page to know of any latest LTF credit card or the best one that you shouldn’t miss. ✅

SBI Energy Opportunities Fund NAV

The NAV (Net Assets Value) of the SBI Energy Opportunities Fund is currently not available as the fund awaits its official allotment date. However, we will try our best to update the current SBI Energy Opportunities Fund NAV here once it's live

Do note that the NAV of an NFO (New Fund Offer) is automatically Rs.10 (till the allotment date). For example, if you make an investment of Rs.5000 in the SBI Energy Opportunities Fund, then you will get a total number of 500 units (₹5000/₹10 per unit) when the mutual fund opens for its official launch (27th February) in this case.

SBI Energy Opportunities Fund: How to Invest?

Customers can invest in the SBI Energy Opportunities Fund through their discount brokers such as Zerodha, Upstox, Groww, and Angel One or full-service brokers including Motilal Oswal, ICICI Direct, Kotak Securities, and Sharekhan. Additionally, customers can also invest through SBI Securities.

You can also visit the official page here to understand better:

Do check out our SBI Promo Codes & Offers to grab some possible savings on your SBI debit or credit cards.

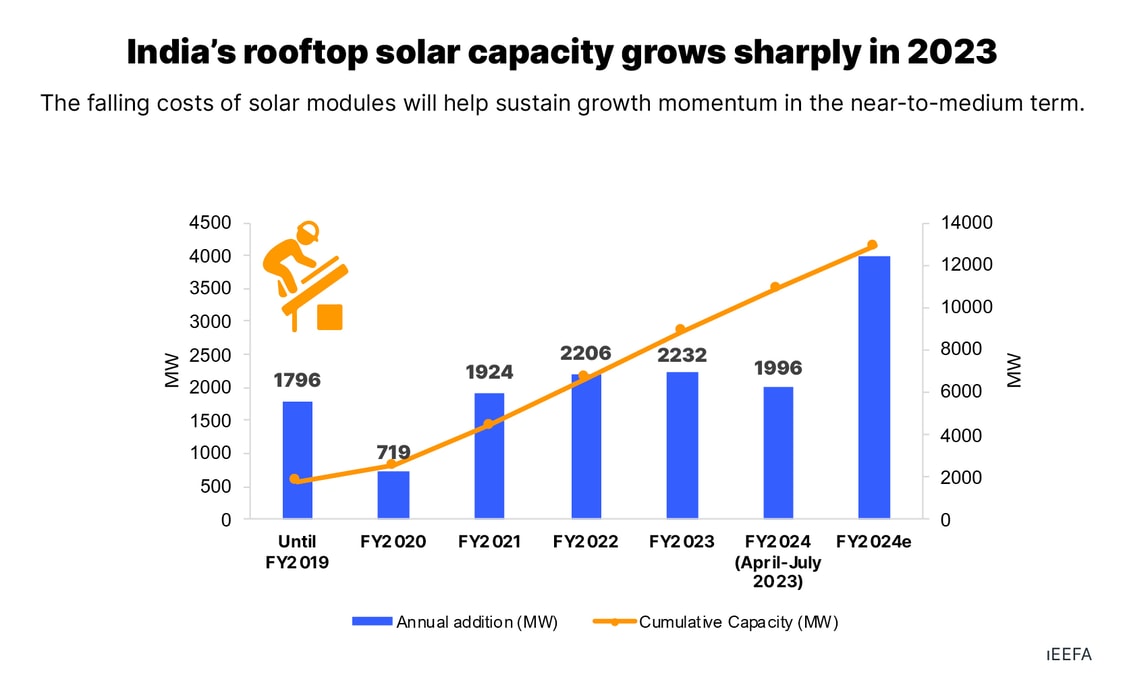

India’s rooftop solar capacity has grown points data from IEEFA

India aims for 500GW of installed renewable capacity by 2030

Union Power and New Renewable Energy Minister RK Singh said last year in September that India will achieve its objective of 500GW of installed capacity by 2030. However, do note that at the present moment, the road seems to be full of challenges as China is still one of the major players in the solar key elements space.

While the government did slash the import of solar panels & elements from China last year, the Basic Customs Duty (BCD) of 40% on solar modules still seems to have remained the same for us consumers.

Hopefully, as India moves to a more renewable source of energy and the government focuses on strengthening the sector, consumers can hope for a cut in the import duty on their solar panel installation.

Source

Power stocks run up sharply in the last few years. Is there still potential to get adequate returns here?

Bhavin Vithlani, the fund manager of SBI Mutual Funds upon asking the question “Power stocks run up sharply in the last few years. Is there still potential to get adequate returns here?” answered:

“Power stocks last year gave exponential returns but on a 10-year basis, the returns are subpar (inferior). Now, the question always is what from here? Now that we have seen consolidation in the space and equally important is that the growth is coming in. The power sector is emerging from severe undervaluation to a close to a fair valuation.” said Bhavin Vithlani, the fund manager of SBI Mutual Fund.

If we look at the stocks of Tata Power, Websol, NTPC or even newer stocks like Borosil Renewable Energy and Inox Wind Energy, the returns in the last (2-4 years) as compared to the previous 10 years are certainly exponential.

So this was about sharing the SBI NFO offer, SBI Energy Opportunities Fund. We hope you found this article useful.

Disclaimer: The above is not an investment advice or suggestion. My goal is to only provide some useful additional information that may help you make your decision. You are required to conduct your own research before investing.

Follow Us

Follow Us

No discount bhai. Example. Say I have two 500 notes and you have 10 100 rupees notes. We both have a sum of 1000 rupees. It's just you have 10 100 rupees notes, your wallet will be fuller and look nice. 🙂