Keystone Realtors Ltd. is a Mumbai-based real estate company that is popularly known as Rustomjee. The same real estate company, KRL has not put out its IPO in the stock market and you can apply for it between a price range of ₹514 to ₹541 per share. The bid started today on the 14th of November and will continue until Wednesday, the 16th of November. This article will talk about the GMP of Keystone Realtors IPO, its subscription status, and everything else you need to know.

IPO or Initial Public Offering is nothing but a company’s way of asking people to invest in its business while sharing its profits and losses too. When a company, like Keystone Realtors also known as Rustomjee, gets listed in the stock market, it has to issue its IPO which is to be purchased by the general public. This gives a part of the ownership of the company to the buyers while the company gets money to carry out its business transactions.

Now that you know what an IPO is, it’s better to know more about the currently live IPO of Keystone Realtors Limited, right?

Keystone Realtors IPO All Details and Full Review

Keystone Realtors Ltd IPO is now live and you can use your Demat account to subscribe to this IPO. But before applying for a company’s IPO, there are certain factors you should consider looking at. Things like GMP (Grey Market Premium), price, date, subscription, and other financials can prove to be vital when making any trade-related decisions during IPO issues. So, we have talked about all such important things right below:

Keystone Realtors IPO GMP Today (Grey Market Premium)

The current GMP of the Keystone Realtors IPO is ₹5. Generally, a higher GMP is considered better according to the market sentiments. So this lower GMP of ₹5 for the Rustomejee IPO would probably hit hard when the shares of this real estate company get listed in the stock markets, probably on the 24th of November. Fingers crossed, let's hope for the best.

When buyers bid for an IPO at high prices, its GMP is said to be higher while things are exactly the opposite when buyers bid at lesser amounts for the same IPO. So a higher GMP indicates a better earning opportunity if you are looking for an IPO to invest in. IPOs with high GMP are likely to open at higher prices than their bid prices.

Keystone Realtors IPO Price and Bidding Date

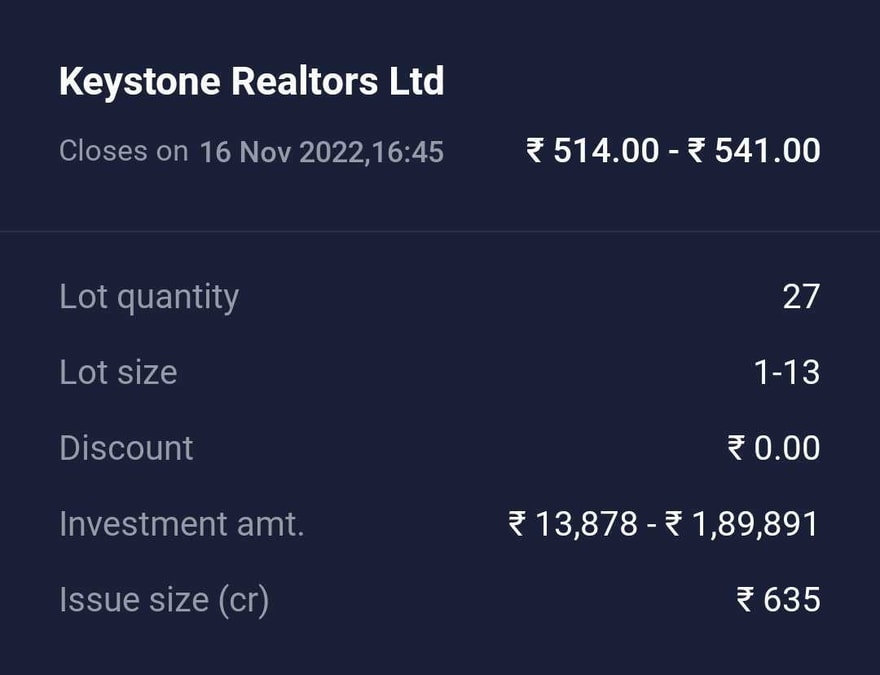

The Keystone Realtors IPO went live today just when the stock market opened and it has a price range of Rs 514 to Rs 541. So buyers can place their bids anywhere between Rs 514 to Rs 541, where the minimum investment is Rs 13,878.

The number of shares that each lot contains is 27. So if you can manage to get one lot of the Keystone Realtors IPO, you will get 27 shares of the company.

Keystone Realtors IPO Issue Size

A company, while getting listed in the stock market, solely focuses on getting the highest possible sum of money to carry out its business activities. With the same goal in mind, Keystone Realtors or Rustomjee’s IPO issue size is ₹635 crores.

Breaking up this amount, you would see that the real estate company has issued fresh shares of ₹560 crores while its promoters have put in an Offer for Sale or OFS worth ₹75 crores.

Keystone Realtors or Rustomjee’s Future Plans, Debts, and Projects

Keystone Realtors Ltd’s first priority while issuing its IPO is to pay its debts worth ₹341.6 crores. So when we deduct the amount from its issue size of ₹635 crores, Rustomjee plans on using the balance amount for its future projects.

Keystone Realtors IPO Listing Date

The listing date for Keystone Realtor’s IPO is expected to be around the 24th of November, 2022. Once listed, all the buyers who would be lucky enough to get their ordered shares would be able to see their holdings in their portfolios.

If you have applied for the IPO and did not get the shares, don’t worry. When you apply for an IPO, the required amount is blocked in your account, rather than getting debited. So if you do not get an IPO, the same amount will be unblocked and you will be able to use it without any problems.

Keystone Realtors IPO Subscription Status Today

Although the Keystone Realtors IPO saw a slow start with just 0.43 times subscription on the 16th of November, the IPO issue now shows a good sign. As of today, the Keystone Realtors IPO is subscribed 2.01 times its issue size. It is quite a big number which may be a good sign too. Of the total subscription rate of 2.01 times, 0.53 belongs to the retail category itself.

Rustomjee IPO Allotment Today!

The IPO of Keystone Realtors Ltd. closed on the 17th of November and its allotment date was fixed to be the 21st of November. So, all those investors who were lucky enough will get the shares of Rustomjee. If any investor has not been allotted any IPO lot, their invested amount would be unblocked or say, refunded to them on November 22.

Once the allotment status is confirmed, Keystone Realtors' shares would be credited to the Demat account of the investors who were allotted the IPO lots. So if you are one of those investors, make sure to check your e-mail and SMS to not miss any updates on your portfolio.

Keystone Realtors: More Details about the Real Estate Company

Keystone Realtors Ltd was founded in 1995 and its current chairman and managing director is Mr. Boman Irani. Till now, the company has completed many real estate projects under the brand name ‘Rustomjee’, the same name that everyone knows of. The company has completed more than 30 projects in Mumbai that include affordable housing projects, super premium ones, and others between both these categories.

Talking about its current capital, Keystone Realtors has an authorized capital of around Rs 23,600 Lakhs and a paid-up capital of around Rs 10,355 Lakhs.

To know more about the current conditions and financials of the company, we recommend you go through the Keystone Realtors IPO Public Announcement.

Keystone Realtors IPO: Should You Buy it or Not?

Your final buying decision should never be influenced by what others have to say, but rather by your own research and understanding of a company and its performance in the long run. Thus, we would suggest you get a thorough understanding of Keystone Realtor’s financial conditions, the current market trends, and the IPO price to determine whether you should apply for the Keystone Realtors IPO or not.

How to Apply for Keystone Realtors IPO?

Applying for an IPO is the easiest thing that needs no effort at all. If you already have a Demat account, you may not even need any instructions. For those who do not have a Demat account, you can use stock trading apps like Zerodha and Upstox to open a Demat account within a few minutes. We would recommend you download the Paytm Money App to start your trading journey.

But if you prefer other apps like Zerodha and Upstox, we have some discount coupons and offers for you to get benefited from:

Once done, do let us know whether the Keystone Realtors IPO is worth buying or not. This is everything you need to know about this latest IPO in the Indian stock market. Do let us know if you would like to apply for this IPO in the comments section below. Please make sure to state your reasons too as this will help us all learn new things and help us grow as a community too.

Last Updated: 21st November 2022

Follow Us

Follow Us

:) just see below, who is smart?