CIBIL, Credit Information Bureau India Limited, is the most well-known of the four credit information companies licensed by the Reserve Bank of India. Before applying for a loan or credit card, you may have noticed that lenders check your credit score to determine your eligibility. This makes having a good credit score crucial for securing a loan. In this guide, you'll learn what a credit score is and how to check your CIBIL score free online.

What is CIBIL Score? How to Check CIBIL Score Free Online?

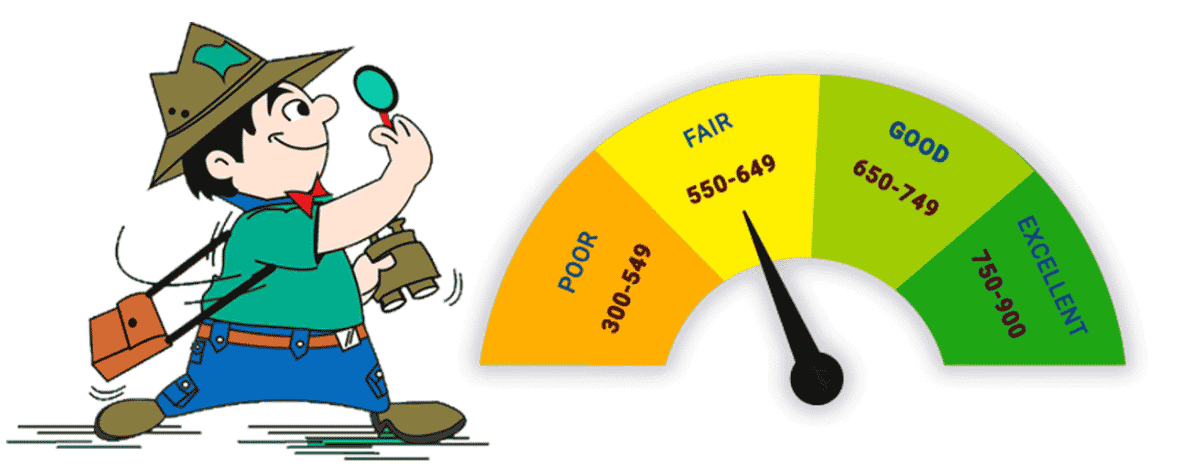

A credit score is a three-digit number that lenders use to evaluate your creditworthiness based on your credit history. This score helps lenders assess how likely you are to take out and repay a loan. Ranging from 300 to 900, a credit score is issued after reviewing your credit history, with a score of 750 or higher being ideal. A strong credit score not only makes it easier to get a loan but also gives you the power to negotiate better loan terms.

In India, your bank shares your credit information with RBI-licensed credit bureaus. While each bureau's credit score may vary slightly, they generally use similar criteria. You can easily check your CIBIL Score online without any hassle.

Why is CIBIL Score Important When Applying for a Loan?

A CIBIL report is a detailed summary of your credit history. Before checking your CIBIL Score free online, make sure you have the following documents ready:

Credit score - Lenders generally see a credit score of 750 or higher as good for approving loans or credit cards. If your score is lower, you may still get credit, but it could come with higher interest rates or stricter conditions.

In simple terms, your CIBIL score is a numerical representation of your creditworthiness. It helps lenders assess your likelihood and ability to repay EMIs according to the loan schedule.

Check CIBIL Score Free Online.

Looking for a personal loan? Whether you're salaried or self-employed, you can get an instant loan without the hassle of endless documentation and paperwork through KreditBee. Use KreditBee Promo Codes to save on processing fees.

How to Check Your CIBIL Score Free Online in 2024?

Check CIBIL Score Free Online -

Type in your name, email ID, and password. Attach an ID proof (passport number, PAN card, Aadhaar, or Voter ID). Then enter your PIN code, date of birth, and also your phone number

Check CIBIL Score Free Online through these Websites.

You can check your CIBIL Score for free online on CIBIL’s official website. Additionally, you can also check your score through these platforms:

Google Pay

One Score

Bank Bazaar Cibil Score Checker

Bajaj Finserv Cibil Score Checker

Paisa Bazaar Cibil Score Checker

Paytm

Cred

HDFC CIBIL Score

SBI CIBIL Score Check

There are many more websites that let you check your CIBIL Score for free online. You can check CIBIL Score Free online by PAN number, you can also check CIBIL Score by Aadhaar Card and CIBIL Score by Mobile Number as well.

Checking CIBIL Score for free online is easy. We've also covered what constitutes a “Good CIBIL Score.” However, if you need instant loans, you can grab a personal loan, gold loan, or business loan through Buddy Loan. Explore the Latest Buddy Loan Offers Here!

What is a Good CIBIL Score? Explore CIBIL Score Range & Benefits

A good CIBIL score ranges from 700 to 900 points and demonstrates to the lender that you are creditworthy. The table below shows what each CIBIL Score means and, as a result, the likelihood of loan approval.

Check CIBIL Score Free Online

CIBIL Score Range

CIBIL Score |

Creditworthiness |

Approval Probability |

<600 |

Urgent Action Needed |

Low |

600-649 |

Murky and Doubtful |

Difficult |

650-699 |

Satisfactory or Fair |

Possible |

700-749 |

Good |

Good |

750-900 |

Excellent |

Very High |

Good CIBIL Score Benefits

A good credit score offers several advantages. As a result, before applying for a loan, an ambitious loan applicant must be informed of the benefits to choose the loan that best suits his wants and expectations.

Higher Approval Chances

Low-interest Rates

Higher Limits

Factors Affecting Your CIBIL Score

There’s often confusion about how your actions and behavior impact your CIBIL score for a personal loan. But once you understand the importance of your credit score, it’s also crucial to know what factors affect it.

Even a single late payment can have a negative influence on your credit score. Late payment indicates a lack of financial planning and management. Your CIBIL score may be reduced as a result of this delay.

As a result, a debt consolidation loan or a line of credit is recommended to minimize the hassle of managing various loans with multiple payback deadlines.

The maximum amount a borrower may spend on a credit card or revolving line of credit is referred to as the credit limit. Lenders typically set a credit limit depending on the borrower's ability to repay. The credit limit is the maximum amount of money somebody may spend on repayment once all other obligations have been met.

If you routinely spend more than 50% of your credit limit, your credit score may suffer. It demonstrates You're not very good at handling and managing money. It is necessary to keep a good credit score. It's critical to maintain your spending under 50% of your credit limit.

Your CIBIL score can drop if you turn to debt frequently for unexpected expenses and apply for multiple loans from different lenders. This suggests poor financial management and an urgent need for credit. Additionally, each time a lender makes a hard inquiry into your credit, it’s recorded and lowers your score.

So, it’s important to know and understand your CIBIL score before applying for a loan. If your score is low, you might face high interest rates or receive a smaller loan amount than you need.

In such a case, strive to enhance your CIBIL score by repaying any outstanding loans and making all of your monthly payments on time. If you have a decent CIBIL score, use it to your advantage and request interest rates from several lenders who would be willing to give you money.

Compare the rates and terms of the loan, a bargain if required, and then choose the best option. There are many more aspects that can decrease your CIBIL score like multiple rejections, not checking your score, Closing Credit Cards that have a high credit limit, etc. So make sure you keep your credit score and finance in check if you are looking to get a home loan or any other loan.

Open IndusInd Bank Zero Balance Savings Account

Follow Us

Follow Us