Flipkart, India’s leading e-commerce giant, is all set to expand its presence in the financial services sector as it has launched the Lifetime Free SuperMoney RuPay SuperCard through its SuperMoney app. This new offering is expected to provide a range of benefits tailored to the needs of Flipkart’s extensive user base, marking a significant step in the company’s mission to enhance its financial ecosystem.

The SuperMoney App was launched around 2 months back, and has garnered 1M+ downloads and 10M+ transactions so far. This app rewards you with upto 5% cashback on every ‘scan & pay’ UPI transaction. You can transfer this cashback to your bank account anytime. It has also got Super Name Drop (send money to a specific named person), Raffle (lucky draw), and Meme Money (send meme to friends) Rewards (cashback, free products, etc).

SuperMoney RuPay SuperCard: A New Financial Powerhouse

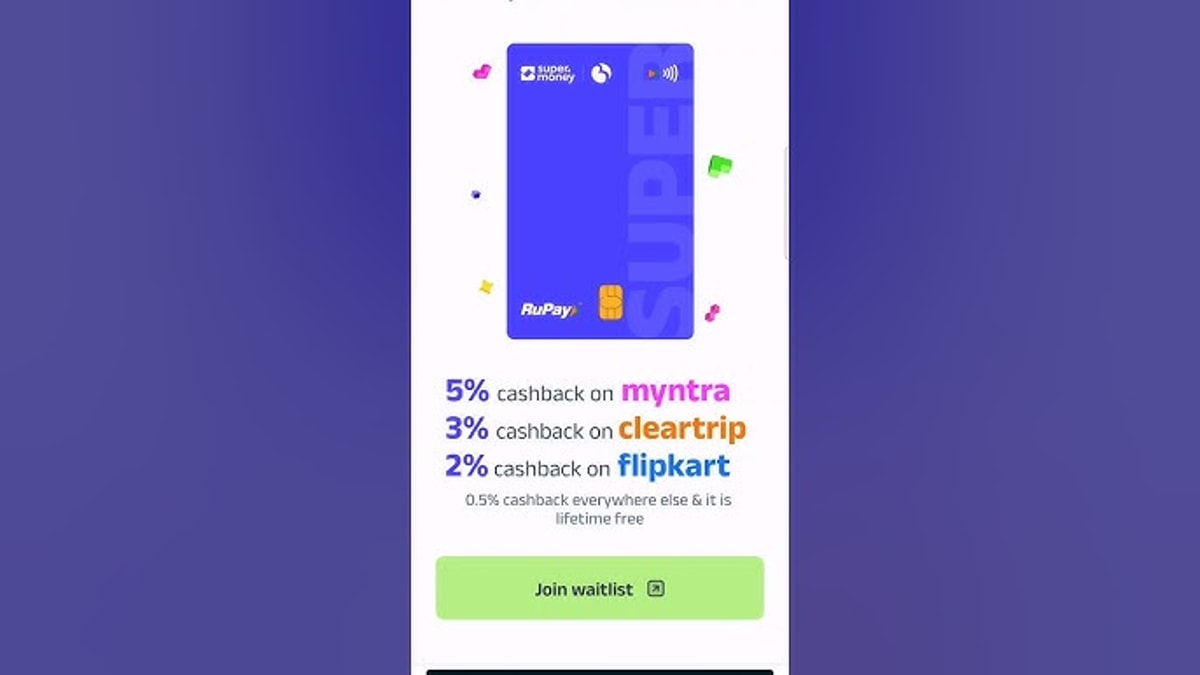

The SuperMoney RuPay SuperCard is integrated with Flipkart’s SuperMoney app, making it easier for users to manage their finances and make payments seamlessly. Designed in partnership with RuPay, India’s indigenous card network, the SuperCard promises to bring a host of features aimed at making digital payments more rewarding and accessible. Besides, Utkarsh Small Finance Bank is its banking partner. Currently, you might get the 'Join Waitlist' option so need to wait to get access to this new Rupay credit card.

Features and Benefits

Exclusive Cashback Offers: The RuPay SuperCard will offer upto 5% Cashback on all UPI ‘scan & pay’ merchant transactions. Early reports suggest that users could also earn significant rewards, making it a highly attractive option for regular shoppers.

- 5% Cashback on Myntra

- 3% Cashback on Cleartrip

- 2% Cashback on Flipkart

- 0.5% Cashback elsewhere

Credit Limit & Interest Rates: Credit Limit on the SuperMoney credit card ranges from ₹90-₹10 Lakh. You need to make a deposit of any amount within ₹100-₹10 Lakh to get started for 'credit-on-UPI'. What's more, you will earn 9% Interest p.a. on your deposit amount! Thus, the RuPay SuperCard offers a competitive interest rate on credit along with UPI accessibility, which could be a game-changer for those looking to manage their finances more effectively.

Seamless Integration with SuperMoney: As part of the SuperMoney app, the RuPay SuperCard will offer users an intuitive interface to track spending, manage credit, and access exclusive deals. This integration is expected to enhance user experience by providing a one-stop solution for all their financial needs.

Wide Acceptance Across India: With RuPay’s extensive network, the SuperCard will be accepted at millions of merchants across India, both online and offline. This ensures that users can enjoy the Rupay offers of the card in a variety of scenarios, from everyday shopping to high-value purchases.

Strategic Significance for Flipkart

The launch of the RuPay SuperCard is a strategic move by Flipkart to strengthen its position in the burgeoning financial services market. As digital payments continue to gain traction in India, the SuperMoney App, coupled with the RuPay SuperCard, is poised to attract a large user base, especially among Flipkart’s loyal customers.

This initiative aligns with Flipkart’s broader strategy to build a comprehensive financial ecosystem that complements its core e-commerce platform. By offering a card that is deeply integrated with its existing services, Flipkart aims to create a seamless and rewarding shopping experience for its users.

Looking Ahead

Flipkart’s SuperMoney RuPay Credit Card is expected to make a significant impact in the digital payments landscape. With features designed to cater to the needs of the modern consumer, the SuperCard is likely to become a popular choice among online shoppers and those looking to take advantage of its financial benefits.

Stay tuned for more updates on this exciting new SuperMoney Rupay Credit Card from Flipkart!

Follow Us

Follow Us

following