The EazyDiner IndusInd Credit Card is a value for money card for Dining enthusiasts. This IndusInd Bank and EazyDiner co-branded card gets you a minimum 45% discount (upto a limit) every time on dining at participating restaurants which is what makes it unique. It also has complimentary movie tickets, airport lounges, hotel stays, meals, brand vouchers, and many other rewards.

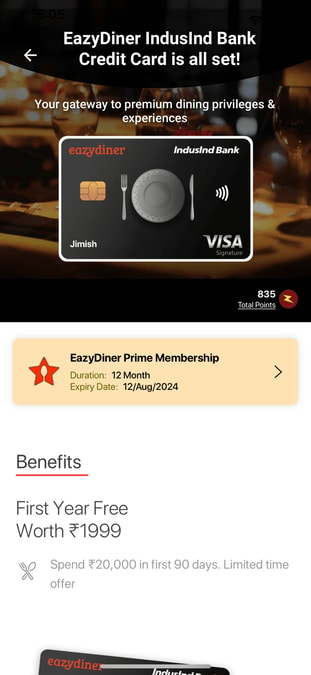

Welcome Benefits & FYF (first year free) Offer on EazyDiner IndusInd Credit Card

The Welcome Benefits of EazyDiner IndusInd Credit Card are as shown below.

First Year Free (FYF) on spending ₹20,000 in the first 90 days or if you have 5000 EazyPoints and 5 completed EazyDiner bookings. You can also checkout the latest Credit Card offers! Also, there are IndusInd Bank offers worth a look.

12 months EazyDiner Prime membership (25-50% discounts on restaurant bill, 2X EazyPoints, better discounts on takeaways, 1+1 buffet deals, complimentary alcoholic beverage) worth ₹2400+GST.

Welcome bonus of 2000 EazyPoints

The Postcard Hotel stay voucher worth ₹5,000

4 coasters

EazyDiner IndusInd Credit Card Reward Points & Features Review

EazyDiner IndusInd Credit Card Reward Points will be earned only for spends up to assigned credit limit in every statement cycle.

10 Reward Points on every ₹100 spent on dining, shopping (online + offline) and entertainment.

2% Reward Rate as 1 Reward Point = ₹0.2 (final Reward Rate will be more adding EazyPoints and other benefits)

4 Reward Points per ₹100 (0.8% Reward Rate) on all other spends except fuel.

3X EazyPoints (EazyDiner loyalty program)

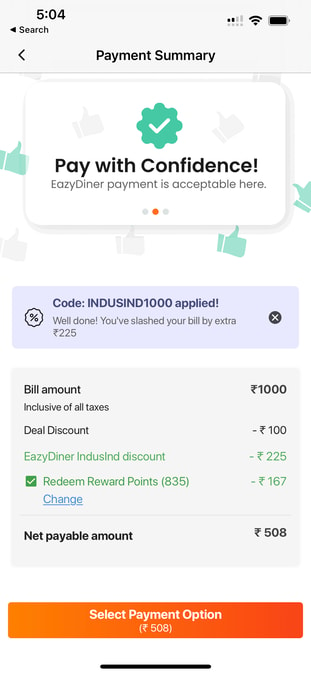

Extra 25% discount (upto ₹1000) every time on restaurant bills (dining + takeaway) by paying via your EazyDiner IndusInd Credit Card (not applicable on consecutive transactions made within 2 hrs at the same restaurant)

2 airport domestic lounge visits per quarter i.e. 8 free lounge accesses in a year.

2 free movie tickets worth ₹200 each every month on BookMyShow (₹4800 savings a year).

Renewal Fee waiver: 2000 EazyPoints

Add-on Cards: Upto 5 add-on cards as complimentary with the card

Total Protect: Insurance cover of an amount equal to the credit limit on your card (includes Add-on cards) for Unauthorized transactions in case of loss/theft of card (report within 48 hrs).

Reward Points can be redeemed at the time of payment via PayEazy against the restaurant bill on the EazyDiner app. One drawback here is that the EazyDiner IndusInd Credit Card reward points can’t be redeemed on IndusMoments (gifts/vouchers portal). You can redeem EazyPoints (redemption ratio varies) for online shopping vouchers, free hotel stays, restaurant food, memberships/subscriptions, freebies, and much more in the EazyDiner app’s reward section.

Note: Reward Points expire at the end of the anniversary year

EazyDiner IndusInd Credit Card Savings Calculator

Restaurant Bill |

₹4000 |

25% EazyDiner Prime Discount |

₹1000 |

25% EazyDiner IndusInd Credit Card Discount |

₹750 |

Reward Points redemption (assuming 400 reward points) |

₹80 |

You Pay |

₹2170 |

Savings |

46% |

Earning Reward Points worth |

₹43 (1.1%) |

You can also apply EazyDiner Coupons to boost savings!

Fees & Charges on EazyDiner IndusInd Credit Card

Joining Fee: ₹2000+GST

Annual/Renewal Fee & Benefits: ₹2000+GST (On payment of Renewal Fee, 12 months EazyDiner Prime Membership will be renewed. Also, you would get 2000 EazyPoints)

Interest Rate: 3.83% (pm) | 46% (py) | Interest-free period of upto 50 days (not applicable if total amount due is not paid in full)

Late Payment Charges:

₹101-500 |

₹100 |

₹501-1000 |

₹350 |

₹1001-10000 |

₹550 |

₹10001-25000 |

₹800 |

₹25001-50000 |

₹1100 |

Above ₹50000 |

₹1300 |

Over Limit Charges: 2.5% of Over Limit Amount subject to a minimum of 500

Returned Cheque: ₹250

Outstation cheque processing fee: Outstation cheques only from IndusInd Bank locations will be accepted.

Cash advance charges: 2.5% of advance amount subject to a min of ₹300

Balance enquiry on non IndusInd Bank ATMs: ₹25

Machine surcharge at ATMs: Passed at applicable rates to customer

Foreign currency mark-up: 3.5%

Railway booking surcharge: As applicable

Fuel Surcharge (min ₹10): 1% waived off on transactions between ₹400-4000 (GST not included)

Cash payment fee: ₹100

Re-issue/Replacement: ₹100

Charge slip request: ₹300

EazyDiner IndusInd Credit Card Customer Care Details

EazyDiner IndusInd Credit Card Eligibility & Documentation

Checkout the Eligibility and Documentation requirements below to Apply for an EazyDiner IndusInd Credit Card.

Salaried or Self-employed

Net monthly income of ₹40,000 or more

18-65 years of age

Latest salary slip (not more than 3 months old)

Latest Form 16

Last 3 months bank statement

Aadhar Card / PAN Card / Passport

CIBIL Score: 750+

EazyDiner IndusInd Credit Card Credit Limit

The Minimum Credit Limit on EazyDiner IndusInd Credit Card is ₹75,000. The actual credit limit will depend on your CIBIL score and salary/income.

This was all about the EazyDiner IndusInd Credit Card. You can also checkout HDFC Regalia for Swiggy DineOut, HDFC Diners Club Privilege for Zomato Pro, and Standard Chartered Ultimate for advance table bookings through concierge services. There are also SBI Card Prime, ICICI Bank Rubyx, and other credit cards for dining benefits.

Follow Us

Follow Us